We all saw it in the news: the CEO of United Healthcare gunned down on the streets of New York City. Tragic, right? A man of his stature and influence, gone in a flash. But here’s the twist—head over to X (formerly Twitter) or any social media platform, and you’ll find a different story. Not mourning, but celebration. People posting comments like, “One less healthcare profiteer in the world” or “Karma finally showed up.” What’s going on? Why did this man’s death evoke so little sympathy from the public?

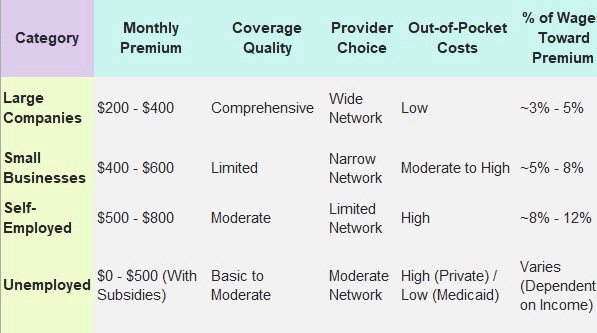

The answer lies in the healthcare system he represented—one of the most expensive, inequitable, and profit-driven systems in the world. For millions of Americans, United Healthcare and its peers symbolize a system that prioritizes corporate profits over human lives, leaving many to choose between medical care and financial ruin. This essay dives into what happens when you get sick in the United States, how it compares to countries like France and the UK, and why the US system inspires such deep resentment. Spoiler alert: It’s not broken. It’s designed this way. Before diving into the details, let me put out these two tables up front. Discussions later in the essay will make references to these two tables.

Falling ill is a universal fear, but what happens when that moment comes depends greatly on where you live. In France and the UK, getting sick may be stressful, but it doesn’t mean financial ruin. In the US, however, the story is different. To understand just how different, let’s first explore what happens when you get sick in countries where healthcare is treated as a public service, and then turn to the US, where it’s a profit-driven industry.

What Happens When You Get Sick in France?

France’s healthcare system is a model of universal coverage. Every resident is covered by Statutory Health Insurance (SHI), funded through taxes and payroll contributions. Most also carry Complementary Health Insurance (CHI) to cover additional costs. For a typical French person, this means that getting sick doesn’t lead to financial panic.

Imagine you wake up in France with a severe headache and fever. You schedule a same-day visit to your doctor, and the out-of-pocket cost is minimal—about €25. SHI reimburses 70% of that cost, and CHI often covers the remainder. Prescriptions, heavily subsidized, cost a fraction of what they might elsewhere.

Even for more severe cases, such as a hospital stay, the financial burden is manageable. A single night in a hospital costs roughly €500, most of which is covered by SHI and CHI. The French system ensures that patients can focus on their recovery, not their bank accounts.

What Happens When You Get Sick in the UK?

In the UK, the National Health Service (NHS) provides healthcare that’s free at the point of use. Funded through taxation, the NHS ensures that whether you need a general practitioner, emergency care, or hospitalization, you won’t face a bill.

If you fall ill in the UK, you call your GP or visit an NHS hospital. There are no direct costs for consultations, treatments, or hospital stays. Medications come with a small fixed charge, currently £9.65 per item in England, but even this is waived for children, seniors, and those with certain medical conditions. A private option exists for those willing to pay for faster access, but the NHS provides robust coverage for all.

The result? In the UK, the stress of illness is emotional, not financial. Patients don’t have to think twice about seeking care.

What Happens When You Get Sick in the US?

Now let’s turn to the US, where healthcare is a patchwork system driven by profit. Access to care depends largely on your employment and financial situation, as the two tables we’ve compiled illustrate.

Scenario 1: Employed by a Large Company

Imagine you work for a Fortune 500 company. You’re among the lucky ones. Your employer likely offers health insurance with substantial benefits. Monthly premiums are low, typically $200–$400, with your employer covering a significant portion of the cost. Deductibles—the amount you pay out-of-pocket before insurance kicks in—are also low. This means you can visit a doctor or undergo treatment without worrying about enormous bills.

Coverage is comprehensive, including access to a wide network of providers and services like mental health care and wellness programs. In this scenario, falling ill is manageable. However, it’s worth noting that even this group faces some cost-sharing, such as co-pays and deductibles.

Scenario 2: Employed by a Small Business

Now, imagine you work for a small business. Your healthcare picture is less rosy. Monthly premiums rise to $400–$600, and your employer may contribute little or nothing to your plan. Deductibles are high, meaning you could be responsible for thousands of dollars before your insurance starts paying. Coverage is narrower, often limiting your choice of doctors and hospitals.

For a small business employee, falling ill can mean postponing care, opting for cheaper (and sometimes inadequate) treatments, or taking on debt.

Scenario 3: Self-Employed or Unemployed

The situation worsens for the self-employed and unemployed. Self-employed individuals must purchase insurance independently, with monthly premiums ranging from $500–$800 and high deductibles. Many forego insurance altogether due to cost.

The unemployed fare worst of all. Without employer-sponsored coverage, they rely on Medicaid (if eligible) or purchase plans through the ACA marketplace. Subsidies can help, but those who don’t qualify face exorbitant premiums—or no coverage at all. The result? Millions go uninsured, and a serious illness can mean financial catastrophe.

What the Tables Don’t Show

The data in the tables highlights the disparities in coverage and cost across employment categories, but it doesn’t capture the astronomical prices of healthcare products and services in the US compared to other countries.

The Cost of Drugs

Take the same prescription drug, for example. In France, government price controls might cap the cost at €10. In the UK, the NHS negotiates prices, keeping the cost around £15. In the US? That same drug might cost $150 or more. Without universal price regulation, pharmaceutical companies charge what the market will bear.

The Cost of a Hospital Stay

A single night in a hospital tells a similar story. In France, it costs roughly €500. In the UK, the NHS spends about £400 per patient. In the US? A night in the hospital can easily cost $3,000–$5,000, or even more depending on the facility and location. This staggering disparity reflects not only the for-profit nature of US healthcare but also its inefficiencies, such as bloated administrative costs.

The Root of the Problem

Why is the US healthcare system so expensive, fragmented, and inequitable? The answer lies in its for-profit nature. Insurance companies prioritize shareholders, not patients. Pharmaceutical companies charge what they please, insulated from regulation. Hospitals compete like corporations, not public services.

In France and the UK, healthcare is treated as a public good—a right, not a privilege. In the US, it’s a commodity. And the result is clear: worse outcomes, higher costs, and millions left behind.

When you get sick in France or the UK, the system is designed to help you recover without financial ruin. In the US, your experience depends on who you work for—or whether you work at all. For the millions of Americans who lack adequate insurance, falling ill can lead to financial disaster. And at the heart of it all is a simple truth: the US healthcare system isn’t broken. It’s designed this way, and it’s designed to profit, not to heal.